Will the Magnificient 7 stay on top?

Will the Magnificent 7 stay on top?

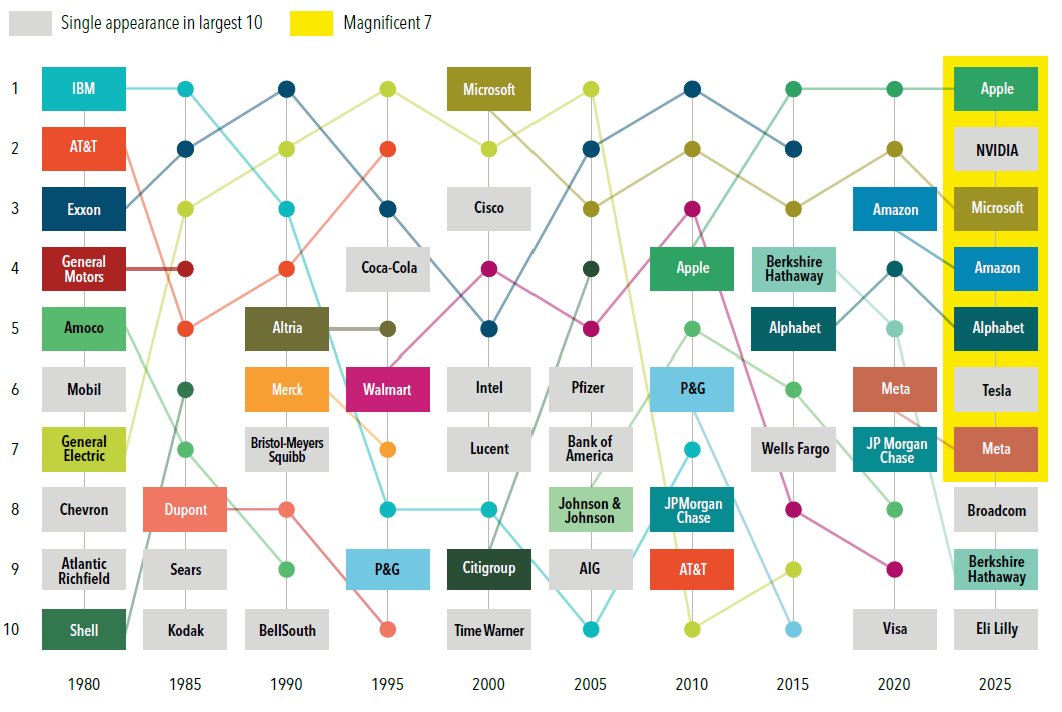

The chart above (from Dimensional Fund Advisors) tracks the 10 largest US-listed companies by market capitalisation at the start of each five-year period since 1980.

At the start of 2025, the “Magnificent 7” occupy spots 1 to 7, with Broadcom (semi-conductor manufacturer), Berkshire Hathaway (Warren Buffett), and Eli Lilly (pharmaceuticals) rounding out the top 10.

It’s tempting to make big, concentrated bets on today’s winners. History suggests a little humility is cheaper.

Staying on top is hard. Only three of the top 10 companies in 1980 were still in the top 10 by 2000, and none of the 1980 top 10 appear in the 2025 list.

Industries rotate. Today’s list is dominated by technology. In 1980, six of the top 10 were energy companies.

Technology lifts more than technology stocks. Breakthroughs tend to spread and companies in many sectors adopt new tools, improve productivity, and take market share.

We’ve also shared research showing that once a stock breaks into the top 10 in the US market, its returns over the following 5 to 10 years have historically lagged the broader market by around -1.7% per year.

We have seen this with CSL in Australia – after becoming the largest company by market capitalisation on the ASX in February 2020, its share price has fallen -42% whilst the ASX 300 has risen by +34% over the same period.

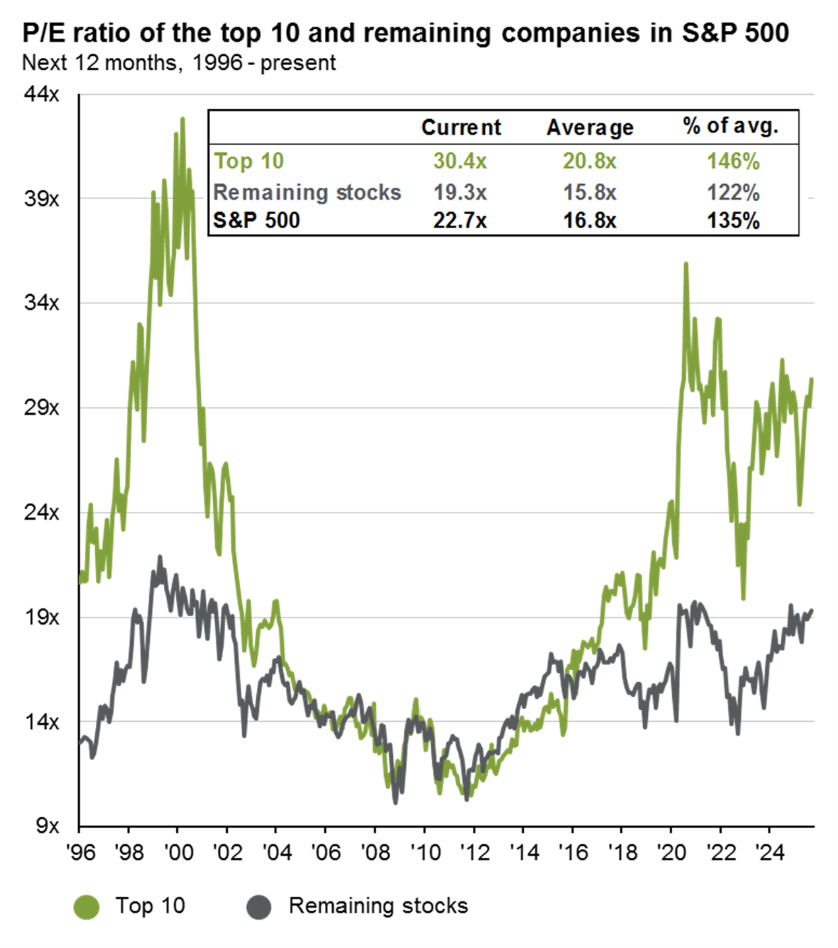

It is worth noting that whilst the current top 10 U.S stocks have price to earnings valuations around 50% higher than the rest of the market (as this graph shows)…

However, their earnings growth has been much higher than the remainder of the market and this is expected to continue for the next couple of years (as this graph shows):

Source: JP Morgan

The Magnificent 7 may remain great businesses but being a great business doesn’t always translate into being a great investment from a very high starting price. Staying diversified matters now more than ever.

Author: Rick Walker