Market downturns are part of the journey

Global financial markets have been strong in recent years. In the past 5 years since the COVID shock rattled markets, the Australian stockmarket is up +47% and the U.S stockmarket is up +94%. But markets don’t always go up - volatility will always remain an inherent part of investing.

It’s natural to feel a little anxious when stock markets experience a downturn. Our advice to manage this anxiety is to limit the time spent checking and tracking your portfolio.

Decades of research in behavioural finance highlight that humans are prone to recency bias - the tendency to place too much emphasis on recent events or experiences when making decisions, often at the expense of a more balanced view. When investing, this bias can lead to an overreaction to short-term market movements, whether that’s buying after a surge or selling during a decline. These emotional reactions can cloud decision-making, pushing you away from a strategic, long-term approach.

The reality is that market declines are more common than you might think (or remember). Looking at the Australian stock market (as measured by the ASX200) over the 31 years from 1994 to 2024, the index returned an average of 8.8% per annum. Of those 31 years, 22 saw positive returns. If you had invested $100,000 in January 1994, by December 2024 it would have grown to $1,368,000.

But what did you have to endure to achieve these returns? The intra-year declines (period from 1 January to 31 December) in the ASX200 ranged from -2% to -47%. In the graph below, the red dot is the intra-year decline for each calendar year, and the grey column is the actual return over the 12 months.

Source: JP Morgan

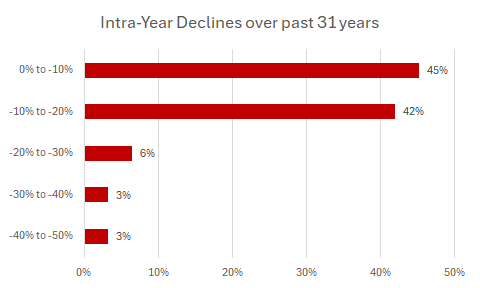

When we group these intra-year declines into 10% bands, the results show just how frequent and varied volatility can be:

In over 50% of the 12 month periods the stockmarket fell more than -10% at some point.

The key takeaway is clear: volatility is a normal part of the market cycle, and while it’s understandable to feel concerned during turbulent times, focusing on facts and continually educating yourself can help you maintain a rational, long-term investment strategy.

When a new client asks what returns they can expect over the next 12 months, we offer the following guidance:

There’s a 2 in 3 chance that your return will be positive.

There’s a high probability that at some point in the next decade your portfolio will experience a decline of -20% or more before bouncing back. And when markets fall, that is when we want to buy.

The less you fixate on daily market swings, the more likely you are to earn the long-term returns needed to fund the lifestyle you want.

Remember, successful investing isn’t about short-term noise, rather it’s about staying the course, managing your emotions, and keeping your focus on long-term goals.

Author: Rick Walker