Financial regrets of older people

Ah regret. A feeling of sadness, repentance or disappointment. The emotion of wishing one had made a different decision in the past.

Life is short and moves pretty fast. When it comes to investment planning, by the time many people realise they’ve made a mistake, it can be too late to do anything else. Except work longer.

Economists Abigail Hurwitz of the Hebrew University of Jerusalem and Olivia Mitchell of the University of Pennsylvania’s Wharton business school recently conducted a survey of older Americans on the subject of financial regret. They polled 1,764 Americans over the age of 50, with the average age being 72.

What they found was interesting and useful.

Older Americans have five major financial regrets. One or two are quite surprising. And those regrets increase, dramatically, when people are encouraged to think more about how long they are likely to live.

The number one financial regret, shared by 57% of respondents, was not having saved more for their retirement during their working years. The phrases commonly used in blaming themselves were “not planning ahead” and “living day to day”.

Number two on the list was a surprise – not buying long-term care insurance to pay for a nursing home or similar. We know the US and Australia have different approaches to aged care and insurance, but in the Australian context this regret relates to not planning for the cost of aged care needs. Most people who have seen parents or loved ones experience troubling aged care scenarios want to ensure they have enough financial assets to give them greater control over how they are cared for in later life.

This is not a simple thing to plan for, as none of us know what our future needs will be, and what they may cost. In the US there appears to be a misunderstanding, especially among non-retirees, that Medicare or the government will pay for 100% of your stay in a nursing home.

In consultation with an aged planning expert, Lorica Partners includes a generic aged care assumption in our planning which equates to $75,000 per annum in the last three years of life for at home nursing care. This amounts to $450,000 for a couple – not a small number. Some clients opt to budget to spend even more.

The third regret shared by 37% of respondents was not working longer. The reason for the regret is likely retiring from something, rather than retiring too something.

Number four, shared by 33% of respondents, was regretting not investing more in a lifetime annuity or similar product to produce income for life. In the Australian context, this means contributing more money into superannuation. And remember in Australia, there are tax benefits for the first $27,500 you put into super each year – it’s the best tax deduction you can receive.

Number five on the list doesn’t really have an Australian equivalent – regret of claiming social security payments too early. The longer you wait in the US to claim social security, the larger your cheques become. For a few lucky Australians, having a defined benefit pension may be an equivalent.

As part of the survey, the researchers also gave some of the subjects objective information about longevity, showing them mathematically the chances that they would live to a ripe old age. The result? Financial regrets went up.

In some cases, they went up a lot.

“Healthy people given objective longevity information were 43% more likely to express regret about not having saved more,” Hurwitz and Mitchell report. Those given the objective data about survival probabilities “expressed twice as much regret about not having purchased insurance, and 2.4 times greater regret for not having purchased lifetime income payments,” they write.

So, if a key to preventing financial regret in old age is to think more, and earlier, about how long we’re likely to live, reflect on these statistics for Australians:

Australia has the third highest life expectancy in the world (behind Monaco and Japan)

Life expectancy at birth for a male is now 81.3 years and 85.4 years for females

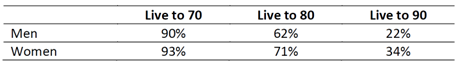

For a 65-year-old, the probability of living to older age is:

The research shows a major reason older people end up with financial regret is because people had inaccurate perceptions of how long they were likely to live. It appears when people have objective longevity information when they make key financial decisions it can help people avoid making mistakes and hence avoid regret in later life.

As a starting point for our planning, we assume clients will live to age 95. Whilst some people think this is optimistic, given the socio-economic background of our client base, we think this is prudent.

Author: Rick Walker