2023 Year in Review

After posting double-digit losses in 2022, stocks soared, and bonds rebounded in 2023.

Economic resilience in the US and elsewhere is helping boost the global outlook, but 2023 showed why planning for uncertainty is prudent.

2023 was a great example of why predicting the future is impossible. Sentiment was very negative at the start of the year. In early 2023, Bloomberg published its annual Almost Everything Wall Street Expects article, and its predictions included an “unavoidable” hard economic landing and global equities to plunge as global recession hits.

In November 2022, CNBC asked 761 people in the US who owned at least $1 million in investment assets how stocks would perform during the next year. Fifty-six percent of them responded that U.S. equities would lose at least 10%. Over the previous half-century, stocks had declined by that much only 6 times.

What did happen next always happens. New information came into the market and was absorbed into prices. Much of the news was completely unexpected, and some seemed a big deal at the time before amounting to little more than media headlines. Here were some of the big stories each month of 2023:

January – China relaxed COVID-era restrictions and reopened its borders.

February – The US Federal Reserve scaled back interest rate rises as inflation eased.

March – US regional bank problems arose (Silicon Valley Bank collapsed); Credit Suisse was forced to merge with UBS.

April – RBA paused on official interest rates after 10 straight increases.

May –The World Health Organisation declared an official end to the pandemic.

June - Russian warlord Prigozhin, in a challenge to Putin, staged a march on Moscow.

July – US inflation fell to a two-year low, raising hopes for an end to interest rate rises.

August – China’s economy slipped into deflation amid growing property sector strains.

September – A rout in bond markets sent US Treasury 10-year yields to a 16-year high.

October – Israel attacked Gaza in reprisal for a Hamas assault on civilians.

November – US President Biden met China’s leader Xi in a bid to mend relations.

December – Israel-Hamas truce ends, as Israel launches attack on Gaza.

So, another eventful year. In 2020, the big, unexpected event was COVID. From 2021, it was the emergence of inflation. In 2022, it was Ukraine. If you believed many of the forecasts at the start of 2023, a global recession looked to be on the cards this year.

Yet, confounding many forecasters, the US economy continued to perform relatively strongly through to November. In the third quarter of 2023, official figures showed it growing at an annualised rate of 5.2%. That is a long way from recession.

Australia, too, proved resilient. Having raised cash rates 12 times between May 2022 and June 2023, the RBA paused for four months and then resumed raising in November to 4.35%, citing a stronger-than-expected economy and more persistent-than-expected inflation.

Financial Market performance

The performance of major asset classes in 2023 are summarised below:

Australian stockmarket (ASX 300) +12.1%

U.S stockmarket (S&P500): +26.3%

Global stockmarket ex Aust (MSCI) +22.3%

Emerging Markets (MSCI) +10.3%

Fixed Interest (short-term) +3.9%

Fixed Interest (longer-term) +4.1%

The graph below shows the trajectory of the MSCI index, which tracks all global stockmarkets, over 2023:

MSCI All Country World Index (net div.) in 2023

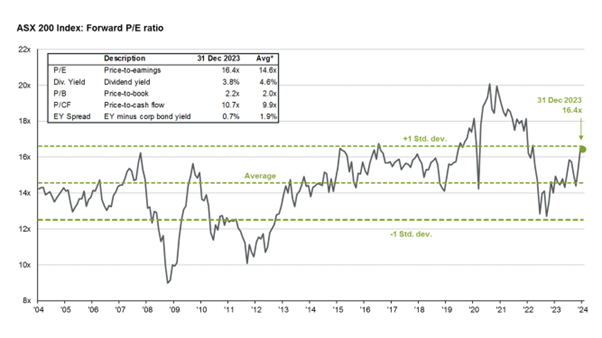

Australian stockmarket gains were driven by iron ore and banks as investors anticipated interest rate cuts in 2024. The forward price to earnings ratio of the ASX 200 is currently 16.4x, above the 20 year average but down from 2021:

Source: JP Morgan

Inflation remains a bigger issue here than in the US and Europe. US inflation continued to retreat from June 2022’s four decade high of 9.1%, with the 12 month rise in consumer prices falling to 3.4% in December 2023, a lower level than many expected.

Interest rates in the US are predicted by the market to fall by 1.5% during 2024 (as currently priced in by the market). Wages - one of the lead indicators of underlying inflation – fell in 2023 without the need for materially higher unemployment, and job openings declined quickly as participation rates increased. This is possibly due to people re-entering the labour market as they used up savings to cope with rising prices.

In Australia, the market is predicting an 80% probability of a 0.25% rate cut in May 2024. Core inflation is expected to fall below 3% in Australia by the end of 2023 (our data is released late).

A year that many speculated would be lacklustre for US stocks saw the S&P 500 post gains of 26.3%. Among the strongest performers in 2023 were technology stocks, recovering after a poor showing in 2022. The tech-heavy Nasdaq rose 44.6%. Around two-thirds of the U.S stock market’s gains can be attributed to the Magnificent 7, being Apple, Alphabet (Google), Amazon, Microsoft, Meta (Facebook), Nvidia and Tesla.

Rather than seeking additional exposure to these mega cap stocks, Lorica Partners believe investors are better off in the long-term by ensuring their portfolios are broadly diversified, positioned to capture the returns of whatever companies may rise to the top in the future. For example, some investors have focused on buying stocks associated with electric vehicles, but the worst performing stock in the ASX 200 in 2023 was lithium miner Core Lithium, which fell 76%.

Global stock markets, as measured by the MSCI All Country World Index, also bounced back after posting their worst year since the financial crisis. The MSCI rose 22.2% even as geopolitical tensions increased, with war continuing in Ukraine and hostilities erupting in the Middle East.

After decades of lagging behind, Japan has lately been a bright spot in global markets. From 1990 to 2022, Japan saw its share of the global market cap decline from 40% to 6%. But since September 2022, Japan has posted a return of 28.1%, with stocks there nearing an all-time high.

In the bond market, US Treasuries rebounded after posting their worst annual return in decades in 2022, with the Bloomberg US Treasury Bond Index gaining 4.1% vs. -12.5% in 2022. But it was not a smooth ride. Despite rising bond prices generally, yields (which fall when prices rise) were higher than they have been for most of the past decade. The 10-year Treasury yield touched 5% in October for the first time since 2007, before pulling back below 4% by year-end.

For the entire year the yield curve was inverted as the 10-year yield was lower than three-month bills. While some see yield curve inversion as a foreboding signal of a recession or stock market downturn, data from the US and other major economies show yield curve inversions have not historically predicted stock downturns consistently. And no US recession was declared in 2023.

In Australia, the predicted residential mortgage cliff in late 2023, as fixed-rate mortgages ended, has – to date – been navigated through higher immigration, an ability to work more hours, more excess savings, and supportive fiscal policy by the government.

What’s in Store for ’24?

Many variables are in play for markets this year, from wars in Ukraine and the Middle East to questions around interest rates. Markets will also closely follow the upcoming presidential election in the US. But it’s worth noting the political party that wins the White House is just one of many factors to consider when pricing assets, and stocks have generally trended upward regardless of which party holds the presidency. This may be reassuring when one considers the difficulty, or perhaps futility, of trying to guess what is going to happen in 2024—or any year.

Author: Rick Walker