2023 Financial Year in Review

After a tumultuous 2022, financial markets have been generally strong in the first half of 2023, resulting in solid returns for the 12 months to 30 June 2023.

Returns in 2022 were battered by strengthening global inflation, but in 2023 we have seen signs of inflation cooling. Publication of inflation figures happens well after month end, but for the 12 months to 31 May 2023 Australia’s inflation rate was 6.1%, but since the peak in December 2022, inflation is now tracking around 2.5%. We are moving in the right direction, which might explain why the Reserve Bank left the cash rate unchanged at 4.10% at their July meeting last week.

Inflation in the US to 31 May 2023 was 4%, but the US Federal Reserve may still increase rates if inflation doesn’t cool further. The US cash rate is currently higher than Australia at 5.0%.

The rapid rise in interest rates left some US regional banks, such as Silicon Valley Bank, in precarious financial positions based on how they were managing their liquid assets, resulting in three of the four largest bank failures on record (after Washington Mutual in 2008). Silicon Valley Bank ended up being sold to First Citizens Bank, and other lenders similarly found themselves with new owners.

Equity markets

The returns of some key indices for the 12 months to 30 June 2023 were:

Australian stockmarket (ASX300): +9.4%

US stockmarket (S&P500): +17.6%

Nasdaq 100: +25.0%

UK stockmarket (FTSE250): +1.9%

MSCI World ex Australia Index: +19.3%

MSCI Emerging Markets Index: +2.2%

The world’s largest stockmarket, the US, reached a two year low in October 2022, but has since entered a bull-market mode (which means a 20% gain from the prior trough). The graph below shows all bull and bear market periods for the S&P500 over the past 65 years:

Source: JP Morgan

Historically, US equity returns following sharp downturns have, on average, been positive. A broad market index tracking data from 1926–2022 in the US shows that stocks tended to continue to deliver positive returns even after the initial recovery from a bear market:

Source: Dimensional - Fama/French Total US Market Research Index returns, July 1926–December 2022

Among the strongest performers so far in 2023 have been technology stocks, recovering after a poor showing in 2022. Much of the stock market’s gain can be attributed to just a handful of companies, led by NVIDIA, which saw strong chip sales as interest in AI built.

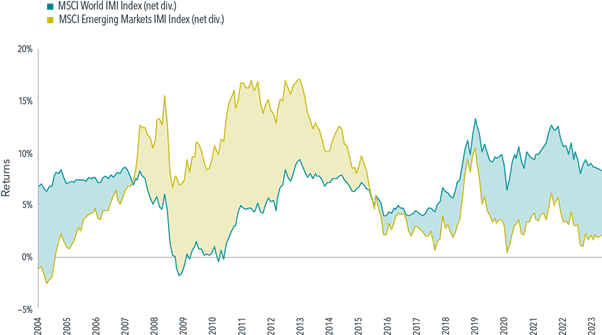

Recent history reminds us that emerging markets can be volatile, but they represent a meaningful piece of the investment opportunity set, accounting for more than 11% of the total global equity market and providing potentially valuable diversification for an investor’s portfolio.

Earlier this century, the strong performance of emerging markets in a sense offset the weaker performance of developed markets (see graph below). In recent years, though, the returns of emerging markets have lagged those of developed markets. But taking the long view on the opportunities emerging markets hold can be a benefit for disciplined investors.

Source: Dimensional - Rolling 10-year returns, June 1994-May 2023

Fixed Interest

The returns of some key indices for the 12 months to 30 June 2023 were:

Bloomberg AusBond Bank Bill Index: +2.9%

Bloomberg Australian Aggregate Bond Index: +1.1%

Bloomberg Global Aggregate Bond Index (hedged to AUD): -1.1%

US Treasuries rebounded after posting their worst annual return in 4 decades last year. For more than six months, the yield on the 10-year government bond has been lower than that of three-month bills, keeping the yield curve inverted. Despite rising bond prices generally, yields (which fall when prices rise) were higher than they have been for most of the past decade.

Over the next few years we know bond returns will be strong as this article explains: https://loricapartners.com.au/insights/why-bonds-go-up-and-down

Artificial Intelligence

As noted above, investor enthusiasm for artificial intelligence has been cited among the key drivers for tech stocks’ recent gains. Some people may be starting to wonder what impact AI will have on investing. So far, there is no reason to think AI offers investors predictive capabilities.

Markets aggregate information, but they are forward-looking, reflecting investors’ best estimate of an asset’s value in relation to future expected returns. That makes the market the world’s largest information-processing machine. Its “aggregated intelligence” adjusts as new information comes in, setting prices that buyers and sellers agree are fair for millions of stocks and bonds every day.

AI has been around for a while and can be expected to continue to improve. But we’ve yet to see research that says anyone can outsmart the market—not even artificial intelligence.

Six years ago, IBM’s supercomputer Watson was put to work in an AI-powered Equity Exchange Traded Fund, employing its artificial intelligence to analyse publicly available information and attempt to pick US stocks. Over the past six years the Watson-powered ETF has lagged the broad US market and, by a wide margin, the technology sector.

The lesson? When it comes to processing power, it’s tough to outguess markets.

Author: Rick Walker